China’s Commercial Vehicle Electrification Rate Near 30%

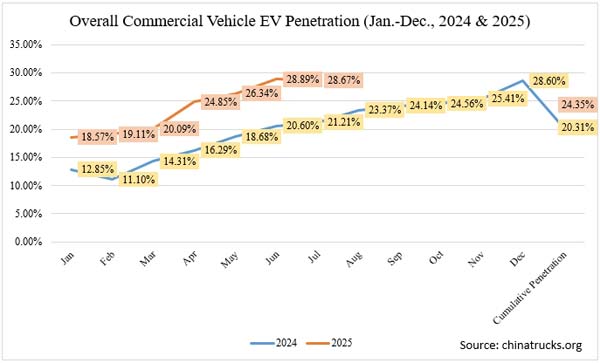

Electric commercial vehicles are rapidly gaining ground in China, with data showing that their penetration rate of the market reached about 29% in June and July. From January to July, the cumulative penetration rate of electric vehicles (EVs) in the commercial segment rose to 24.35%, up from 16.63% during the same period last year. Total new energy commercial vehicle sales in the first seven months reached 429,000 units, a 56% increase from 2024, compared with overall commercial vehicle growth of 6.6%.

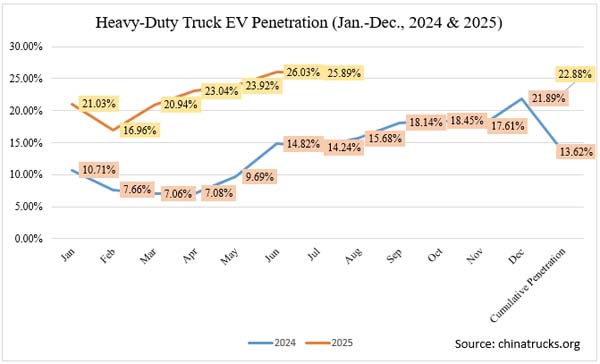

Among specific segments, electric heavy-duty trucks accounted for 25.89% of the market in July, with cumulative sales of new energy heavy trucks nearly 100,000 units from January to July, up 179% year-over-year.

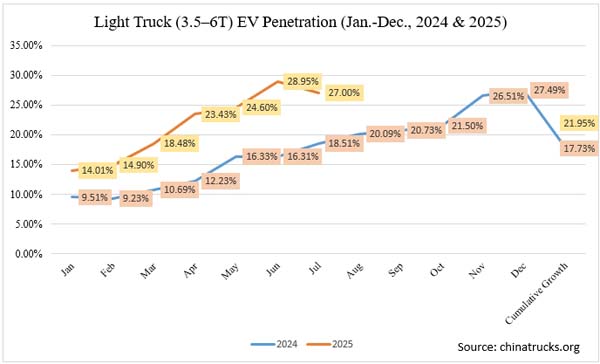

Light trucks (3.5–6 tons) maintained an EV penetration rate above 27% in June and July, with 88,000 cumulative sales of new energy light trucks, up 95% from last year.

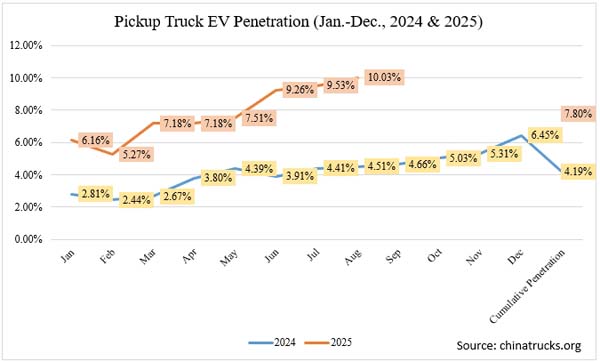

Pickup trucks, which traditionally have lower EV adoption, saw their market penetration rate exceed 10% in July, with cumulative sales of 12,400 units, up 115% from the same period last year.

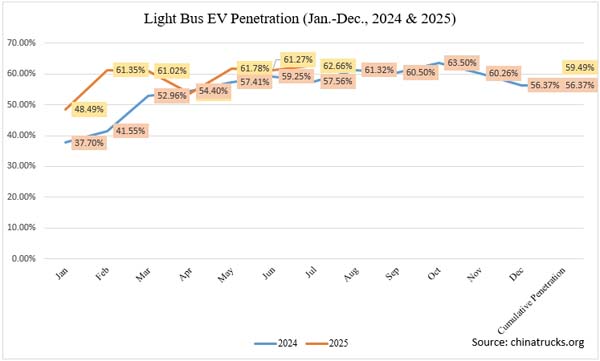

Light buses lead all commercial segments in EV adoption, with cumulative sales of 246,000 units (new energy light buses) from January to July and a cumulative penetration rate of 59.49%, up from 53.13% last year. European-style vans currently show low penetration, representing a potential area for growth.

Based on current trends and the year-end boost from the phase-out of older China IV trucks, sales of new energy commercial vehicles are expected to peak in December. For 2025, total sales of NECVs are projected to reach a record 800,000 units, representing nearly 40% year-on-year growth, with an overall penetration rate of 26% to 28%.

Based on current trends and the year-end boost from the phase-out of older China IV trucks, sales of new energy commercial vehicles are expected to peak in December. For 2025, total sales of NECVs are projected to reach a record 800,000 units, representing nearly 40% year-on-year growth, with an overall penetration rate of 26% to 28%.

Among the most closely watched segments, sales of new energy heavy-duty and light-duty trucks, two of the most closely watched segments, are projected to reach about 190,000 and 180,000 units, respectively. Their penetration rates are expected to be roughly 25% for heavy trucks and 28% for light trucks.

Looking ahead, growth may slow in 2026. This year’s rapid increase is driven by lower freight rates, fewer goods per truck, cost advantages of EVs, and the replacement of older vehicles under policy incentives. Some demand has been pulled forward, and changes to EV purchase tax incentives—from full exemption to half exemption—may temper growth. Overall, the NEV penetration rate in China’s commercial vehicle market is expected to surpass 50% by around 2030.

Views:0

Submit Your Requirements, We Are Always At Your Service.

- China’s Commercial Vehicle Electrification Rate Near 30%

- FTXT Energy Launches Hydrogen Truck Testing in Brazil

- Windrose Technology Welcomes Mexican Business Delegation

- Sinotruk Presents Trucks and Parts at Tanzania’s Sabasaba Trade Fair

- India to Launch First-ever Incentive Program for Electric Truck Purchase

- Tata Motors to acquire Iveco in €3.8Bn deal

- Shandong Heavy Industry Posts 6% Revenue Growth in First Half of 2025

- Foton Reports Strong H1 Sales, Highlights NEV Strategy at Mid-Year Conference

- Beiben Trucks Signs Deals During Inner Mongolia Delegation Visit to Africa

- Superpanther, TÜVNORD Partner to Streamline Global Certification for NEV Trucks

- China's Medium-Duty Truck Sales Drop 19% in July

- China’s Light Truck Sales Hit 138,000 in July

- China’s Commercial Vehicle Market Hits 2.12 Million Units in H1, 2025

- China's Mini Truck Market Drops 20% in First Half of 2025

- China's Medium Truck Market Reaches 59,500 Units in H1 2025

- China Tractor Truck Sales Reach 270,200 in First Half of 2025

- China Light Truck Sales Rise 3% in June; Foton Maintains Market Lead

- China’s Light Truck Exports Poised to Surpass 500,000 Units in 2025

- China's Light Truck Sales Rise 2% in May

- China's Tractor Truck Sales Hit 33,300 Units in May, Up 15% Year-on-Year